Finding the best Private Health Insurance can be tricky. There are a range of insurers and plans available, each with their own unique policy options and levels of cover. This can make the decision-making process overwhelming, and it can be difficult to know where to begin.

Not all policies are equal, and some will align more closely with your own specific needs and circumstances. With this in mind, it’s important to understand how they differ and what the key factors are you need to consider before taking out cover.

To help you do this, we’ve put together a comprehensive guide to finding the best health insurance below 👇.

What Is Health Insurance?

Although different providers offer different types of cover, at its core, all Health Insurance is the same. It provides you with private medical care so you don’t have to rely solely on the NHS.

By going private, you enjoy far shorter waiting times, often with a choice of consultants, treatment, and facilities that are convenient for you. It can give you access to:

- New drugs and novel treatments that may not yet be available on the NHS

- Private hospitals with usually superior facilities, e.g. private, ensuite rooms and round-the-clock visiting hours

- Fully paid-for treatment by your insurer (less any excess).

Why Is Private Health Insurance Important?

We are extremely lucky to have access to free healthcare through the National Health Service; however, not all services and treatments are available on it, and due to resource and budget cuts, waiting times are getting longer and longer.

By having private healthcare, you can get peace of mind, knowing that should you need treatment, you will get it quickly and in some of the best facilities.

Which Type Of Health Insurance Is Best For Me?

Before delving into the nitty gritty of policy options, it’s important to understand that there are different types of Health Insurance available.

This will ensure that you choose a plan that aligns with your particular needs. Whether you’re looking to cover just yourself, your family or looking for a policy suited to an older individual, there’s a range of options designed to meet the needs of different life stages and financial situations.

Individual & Joint Policies

Individual plans are tailored specifically for individuals just looking to protect themselves, whereas Couples Health Insurance is designed to cover two people. The benefit of a joint policy is that there will be less admin compared to if you were to set up two single policies and it can sometimes be cheaper.

EXPERT TIP 🤓

Joint policies can sometimes offer a more cost-effective option compared to two single policies. This isn’t always guaranteed however, so it’s important to do your research before opting for this option.

Senior Health Insurance

Seniors Insurance is aimed at individuals over the age of 65. They are similar to standard Health Insurance Policies, however the age restrictions aren’t limited. Not all providers will offer this type of policy, so it’s important to bear this in mind when looking for cover.

Family Cover

Family Medical Insurance is exactly what it says on the tin. It is cover that protects you and your immediate family (partner and children). Unlike a single or joint policy, which cover 1 or 2 people, it will cover multiple individuals under one plan.

Low Cost Options

Private insurance can be expensive, but the good news is there are affordable health insurance options out there. You can tailor policies and the level of cover on offer to reduce the cost of premiums and make cover cheaper.

What Do The Top UK Private Health Insurance Policies Cover?

This is a good question. Even the best Private Healthcare won’t cover you for everything. It’s vital to understand what is offered as standard, the optional extras that can be added and what isn’t included.

Acute Conditions

Firstly, a policy will only cover you for acute conditions. These are conditions which are short term and can be cured with treatment. This means, chronic conditions, such as Diabetes and Heart Disease won’t be covered as they are long term and can’t be cured.

Inpatient & Outpatient Cover

What your policy will actually cover in terms of acute conditions, will depend on the level of protection you put in place. All medical treatment is split into two categories inpatient and outpatient and there are distinct differences between the two:

- Inpatient Cover

This is any treatment which requires the use of a hospital bed. Either for a day or overnight

- Outpatient Cover

Covers any treatment that you might need that doesn’t require a hospital bed. For example scans and diagnostics.

All Health Insurance policies will include inpatient treatment as standard, however outpatient treatment isn’t included. This is something you will have to build into your policy, and the level you opt for will determine what is included in your cover.

Insurers tend to categorise their Health Insurance products in the following way:

- Basic Health Insurance

Basic Health Insurance only pays for inpatient care and doesn’t offer any outpatient care at all

- Mid-Range Cover

Mid-Range covers some outpatient treatment up to a set monetary limit per year. The insurer offers a range of choices for this limit, such as £500, £1,000 or £1,500 a year

- Comprehensive Health Insurance

As the name suggests, Comprehensive Health Insurance is the best health cover. These plans pay for all eligible inpatient and outpatient care in full.

Do I Need Outpatient Cover?

You don’t have to add outpatient cover to your Private Health Insurance. Having little or no outpatient cover means your premiums will be lower. However, without it you will have to rely on the NHS for outpatient scans and diagnostics. This can often slow down access to private inpatient care.

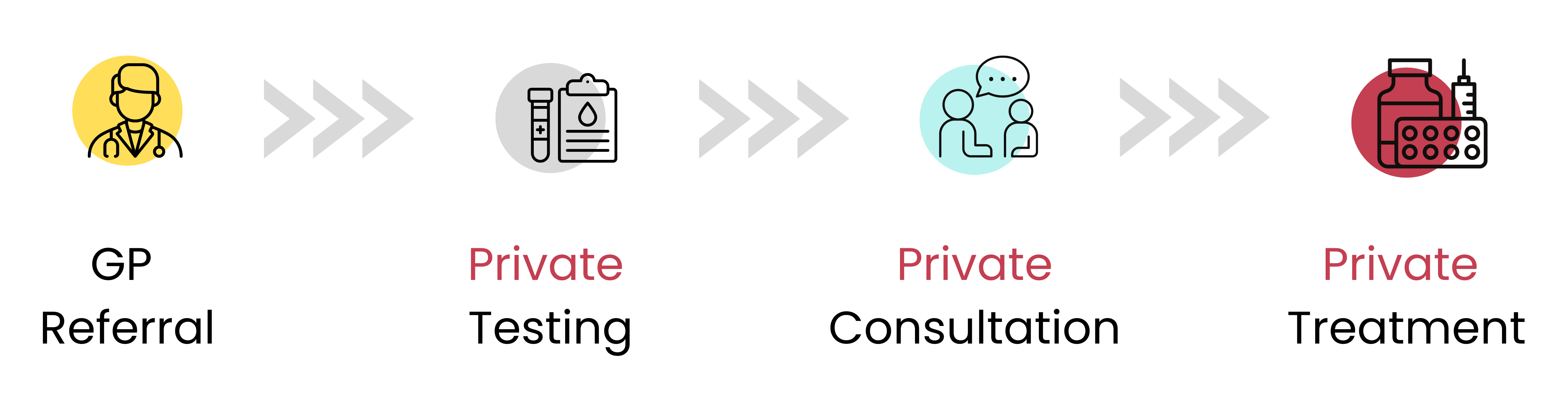

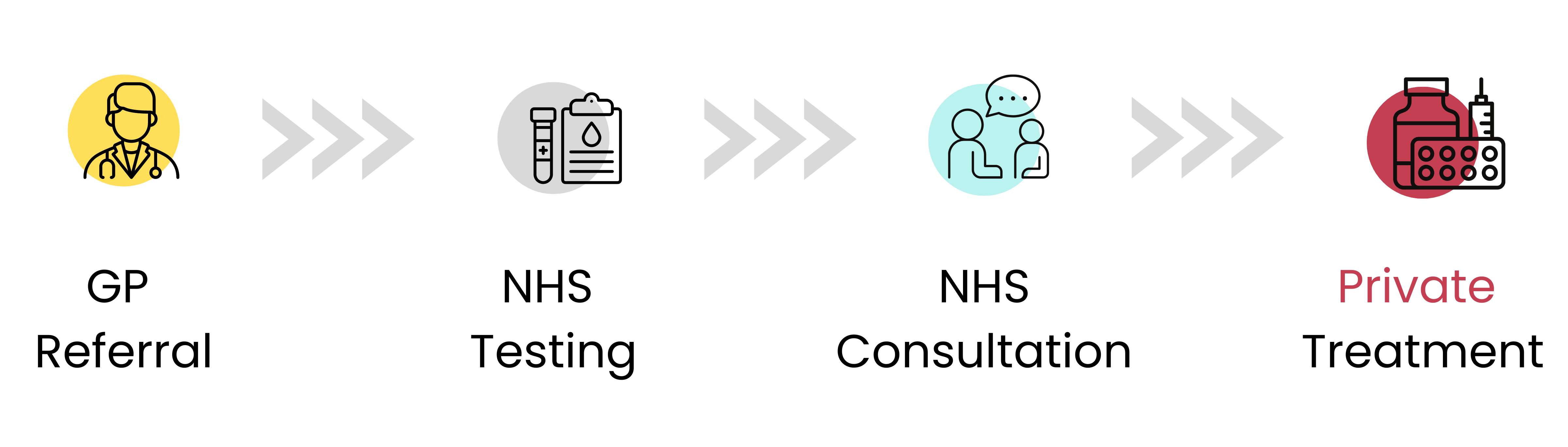

Below shows what the process for treatment looks like with and without outpatient cover.

Treatment With Outpatient Cover

![Private Healthcare Process]()

Treatment Without Outpatient Cover

![NHS Process]()

Good To Know 🤓

Comprehensive Health Insurance policies provide the highest level of outpatient cover. However they are also the most expensive. If you are limited by budget, look at a mid-range plan. Having some outpatient cover is better than having none at all.

Cancer Cover

All policies will include cancer care as standard. This will give you access to cutting-edge treatment that isn’t yet available on the NHS. Benefits of this type of cover can include:

- Giving you the choice of having chemotherapy at home rather than in a clinical setting

- Covering the cost of wigs and prostheses that are required as a result of cancer treatment / surgery

- Money to pay for scalp cooling, to reduce hair loss from chemotherapy

- Donations to a hospice should you need to stay in one to receive palliative care

- Access to home nursing for a certain number of days, where a dedicated private nurse will come to your home to check up on you during your treatment.

How To Choose The Best UK Health Insurance

Regardless of the type of policy you choose, to get the best private health cover, you’ll need to compare some key factors relating to providers and policies. For example, you’ll want to examine:

The Insurer

First and foremost, look at the insurer providing your cover. What are their customer reviews like? How is the claims experience? Do they offer the level of cover you want in the areas you’re most concerned about?

Each insurer will be different in terms of the service and cover they provide. This is why you can’t view them all as being equal. It’s important to compare them to ensure you get the best cover for you.

Policy Options

This is the real nitty-gritty of the policy, laying out exactly what the Health Insurance plan will and won’t cover you for.

- Outpatient Cover

As already mentioned you will have the option of adding outpatient cover to your policy. When comparing insurers look at the different options they provide. Do they offer a mid range plan as well as a comprehensive one?

- Choice Of Excess

The Health Insurance policy excess is how much you agree to pay upfront towards your treatment. You can opt for an excess of zero, which means the insurer picks up the entire bill for your treatment. Or at the other end of the scale, some insurers offer a £5,000 excess. The higher your excess, the lower your premiums. It could be more cost effective to set a higher excess to reduce the amount you need to pay each month. Although, this depends on your circumstances.

- Hospital List

Insurers arrange their hospital lists in tiers. The best Health Insurance cover offers private treatment in the top tier of hospitals. These include world-leading private facilities in Central London. Choose from a smaller list of less prestigious facilities outside of Central London if you want to save money.

- Medical Underwriting

The policy underwriting affects both the cost and the conditions you can claim for based on your pre-existing medical history. We will look at what the best medical underwriting is in more detail below.

Policy Add-Ons

Outside of the core policy features mentioned above, it’s important to look at the additional extras that policies offer. Some may provide more flexibility when it comes to what can be added outside of core cover. When comparing insures look to see if you can add any of the following:

- Therapies Cover

Therapy policy options include things like physiotherapy, osteopathy and chiropractor appointments. Insurers may include it with outpatient cover or add all therapies for an extra premium

- Dental & Optical Cover

Dental and optical cover is always an optional extra for an additional premium. It includes routine dental (e.g. checkups, fillings, crowns etc.) and optical care (checkups, money towards glasses / contact lenses). It reimburses you a set amount towards treatment rather than paying in full

- Mental Healthcare

Mental health policy options include private health treatment from a psychiatrist / psychologist in a private psychiatric facility. One major insurer offers this as standard, but most have it as an optional add-on for an extra premium.

Additional Benefits

All Health Insurance policies pay for private medical care. Alongside that, most insurers offer a range of extra benefits which can take your cover from basic to comprehensive. These might include:

- 24/7 virtual GP services

- Medical helpline staffed by trained nurses for more minor medical concerns

- Mental health support helpline

- Gym discounts

- A cash benefit if you opt for NHS inpatient care for a condition the policy covers rather using your insurance

- A baby bonus if you have a child during your policy

- Parent accommodation for one of your children (who the policy covers) if they require private inpatient care.

EXPERT TIP 🤓

Not all Private Health Insurance companies offer the same additional benefits, so it’s best to check these out insurer by insurer.

Which Is The Best Medical Underwriting For Health Insurance?

If Private Health Insurance is new to you, don’t worry, we’ll make it simple. The way a policy is underwritten refers to an insurer assessing your medical history to decide whether you can get cover or not. You can choose moratorium underwriting or full medical underwriting (FMU).

Moratorium Underwriting

The most common form of underwriting. Moratorium excludes any medical condition for which you’ve had advice, treatment or medication for in the past 5 years.

This is usually on a 2 year rolling moratorium basis. Once you’ve reached the 2 year point on your active policy, your insurer will reconsider any claims for medical conditions suffered before your policy started. For an insurer to do this, you can’t have received any medical attention for the condition in those 2 years.

Full Medical Underwriting

Full medical underwriting (FMU) examines your entire medical history before you take out the policy. It then excludes all pre-existing conditions.

This means you know exactly what you are and aren’t covered for from the start. However, there’s usually very little opportunity to get exclusions removed.

Any health conditions you had more than 5 years ago aren’t generally taken into account when insurers underwrite you on a moratorium basis. However, they will most likely be examined when an insurer underwrites you on an FMU basis.

Which Should I Choose?

When you compare the two options, it all boils down to your medical history.

If you’ve had a minor medical condition in the past then an insurer might decide not to exclude it on an FMU basis once they’ve seen the medical evidence. This won’t likely be the case on a moratorium basis.

How To Get The Best Premiums?

Insurance is very personal, so we can’t offer an exact cost for Private Health Insurance. What you pay will depend on a number of personal and policy factors such as the insurer you choose, your age, location and level of cover.

Ultimately, the more comprehensive Health Insurance becomes, the more you’ll pay each month. For example, choosing add-ons such as psychiatric care or access to the best private hospitals in Central London will bump up the cost of cover.

To give you an idea of what you could pay each month, we’ve put together some example quotes below based on the different factors.

Insurer

Each insurer will charge differently when it comes to premiums. This is because they all have a different appetite to risk. When looking at the best cover for you, make sure you compare the different providers. They may offer very similar policies, but one may charge more for it. The below quote is based on:

- A healthy 35 year old

- Non-smoker

- Office Worker

- Comprehensive cover

- £250 excess

- Brighton based.

Level Of Excess

Opting for a higher excess can significantly reduce your monthly costs. However, it’s important to choose an amount that is manageable for you; remember, this is the amount you’ll need to pay upfront for your care before your insurance benefits begin. Setting an excess that’s too high, while tempting for its cost savings, could lead to financial strain in the event you need to make a claim.

Smokers Vs Non-Smokers

Due to the health risks associated with smoking, some insurers will charge you more if you smoke. However, the good news for those considering quitting: once you’ve been smoke free for 12 months, you’ll be classified as a non-smoker.

Level Of Outpatient Cover

Choosing different levels of outpatient cover can impact the cost of your premiums. The more you add, the higher the cost. With this in mind, if you are limited by budget, think about opting for a basic or mid-range plan.

Age

Age is another big factor that will determine what you pay for your Health Insurance. Unfortunately the older you get, the higher premiums will be. This is due to the fact, with age comes a higher risk of ill health.

Hospital lists

When it comes to Health Insurance, most insurers will offer a standard hospital list. This is a list of facilities where you can get treatment. There are also options to extend or reduce this list. This is one way you can manage the cost of premiums. If you aren’t concerned about where you have treatment you could opt to reduce your hospital list, which would lower your premium amount.

Need Help?

With any of the above options it’s vital to understand how they impact your policy and the treatment you would receive. Before altering your cover, we would always recommend speaking with an expert adviser. Our friendly experts are on hand to help, so don’t hesitate to pop us a call on 02074425880 or email help@drewberry.co.uk.

Who Are The Top 6 UK Private Health Insurance Providers in 2024?

The UK has a few major Private Health Insurance providers to choose from. Each insurer has its own unique underwriting, policy options and pricing philosophy.

It’s important to compare quotes from each provider to ensure you find the right policy for you. It’s not a case of one-size-fits-all when it comes to insurance, as every person has individual needs and circumstances. And the cheapest quote doesn’t always mean it’s the best for your specific needs.

Our expert in-depth review of each of the UK's leading insurance providers

Why is private healthcare better?

Private healthcare isn’t necessarily ‘better’ than the NHS. Often the same consultants and surgeons will work in both the NHS and the private sector.

The main benefit of private healthcare over the NHS is largely the speed at which you’ll be treated. You will also have a choice of facilities you can visit and doctors you can see.

You can expect private ensuite rooms and an environment where friends and family can visit round-the-clock. There’ll also typically be a better quality of hospital food. However, these are generally ‘nice to haves’ rather than essential healthcare services.

We’ve written a guide comparing private healthcare and the NHS, so if you want to read more about why private healthcare is worth it, check it out.

Will it cover pre-existing conditions?

A Private Health Insurance policy is designed to cover acute medical conditions. If it can be treated and cured by medication, that’s an acute condition. Any pre-existing condition you have before taking out your policy is unlikely to be covered. Here we’re talking about major health problems, such as cancer, respiratory conditions, and mental health issues.

If you choose moratorium underwriting, any condition you have suffered or received treatment for in the past 5 years will be excluded.

If you opt for full medical underwriting, any exclusions for existing health conditions will be declared from the outset. When you apply for Private Health Insurance, you’ll have to tell the insurer about any pre-existing conditions.

Does Private Medical Insurance cover overseas travel?

Some of the best UK Private Health Insurance policies include overseas travel cover for a set number of days per policy year as standard. There are also a number of options to upgrade your cover to include travel.

If you’re an avid traveller, you might be better off with an International Health Insurance policy. While we’re lucky to have access to free healthcare in the UK via the NHS, other countries don’t receive state-funded medical treatment. The last thing you want while you’re on holiday is to fall ill and be faced with hefty hospital bills.

How do I make sure I keep the best Private Health Insurance?

Your insurer will write to you annually when your private health insurance is up for renewal.

Each year you may find your premiums rise slightly. This is typically down to medical inflation, which reflects the growing cost of procedures, drugs and treatments.

It’s vitally important you regularly review your policy and premiums to ensure you’re getting the best deal.

As part of our service at Drewberry, we take care of this for all our clients. If we find you cheaper or better cover elsewhere, we’ll also be able to help you switch insurers.

What’s The Best Way To Set Up A Health Insurance Policy?

You have two ways to set up Private Health Insurance. You can either go directly to the insurer or take out cover through an intermediary, such as Drewberry™.

It’s important to recognise the difference in these approaches, as one provides much more protection than the other.

Going Direct To An Insurer

When you go directly through an insurer, it’s a non-advised sale. This means that the insurer only provides you with information on a policy. The insurer has no liability.

As you’ve made the decision yourself, there’s no financial protection if the policy happens to be inappropriate for your needs. The responsibility rests on your shoulders.

Not only is there no protection, it can be time consuming. It’s down to you to approach every insurer on the market and compare quotes from all of them to find the best deal. You’ll then also have to compare the different providers policy documents to see how they stack up against one another.

Get Independent Financial Advice

Alternatively, you can use an independent Health Insurance adviser, such as our expert advisory team here at Drewberry. This is especially important if you have pre-existing conditions.

An independent adviser can use their market knowledge to secure the best terms for your circumstances. We make it simple for you, breaking down those complicated terms, comparing quotes and providing recommendations for your insurance policy, so you get the best possible cover.

EXPERT TIP 🤓

An adviser will do all the heavy lifting for you, but they’ll also provide an advised sale. If their advice is not appropriate and the policy isn’t suitable, you’re financially protected.

Compare Best UK Private Health Insurance Quotes & Get Expert Advice

Finding the best Private Medical Insurance isn’t easy. There are multiple policy options to look at, all of which affect the cost of premiums but also the coverage available.

Some insurers will be better for your circumstances than others. For example, if you can afford a larger excess to keep premiums down, it may not make sense to limit yourself to a provider with £500 as its highest excess.

At Drewberry, searching for the best health insurance for our clients is our bread and butter. We do this every day, so we’ve got the expertise you need.

For help and fee-free advice comparing the top Private Health Insurance companies, don’t be afraid to pop us a call. You can reach us at 02074425880, or you can email help@drewberry.co.uk.

Why Speak to Us…

We started Drewberry™ because we were tired of being treated like a number.

We all deserve a first class service when it comes to issues as important as protecting our health. Below are just a few reasons why it makes sense to talk to us.

- There is no fee for our service

- We are an award winning 🏆 independent insurance broker who works with all the leading UK insurers

- You’ll speak to a dedicated expert from start to finish

- We are very proud of the 3770 and growing independent client reviews rating us at 4.92 / 5

- Claims support when you need it most.

- We are authorised and regulated by the Financial Conduct Authority. You can find us on the financial services register here 🧐

- Claims support when you need it most.